Diminishing value depreciation formula

In this case we know this amount is 20000. Year 1 2000 x 20 400 Year 2 2000 400 1600 x.

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

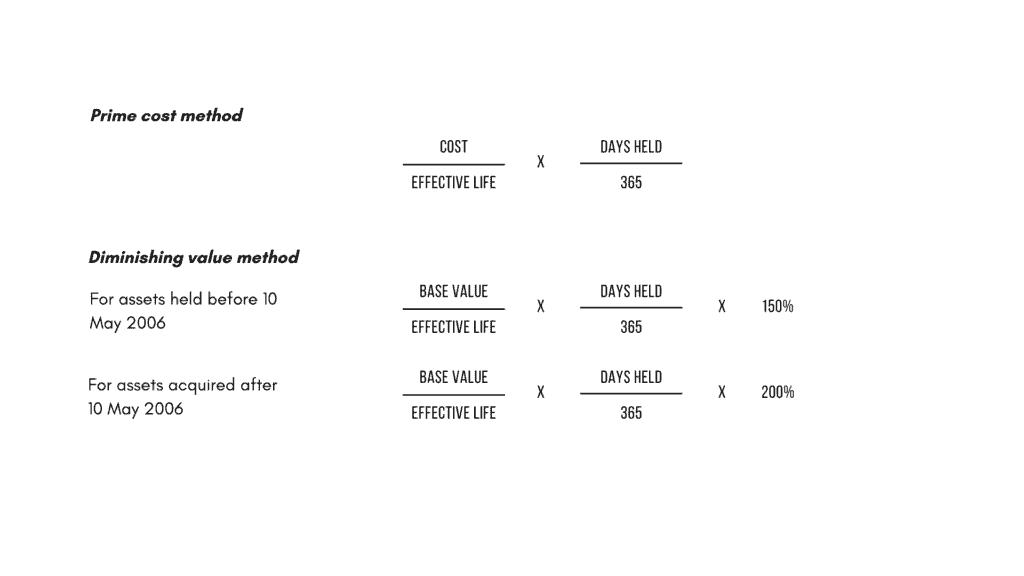

This is how depreciation will be calculated using prime cost method.

. The rate of depreciation is 60. Calculate the depreciation expense using the following formula. 8100 Mathematical Ex See more.

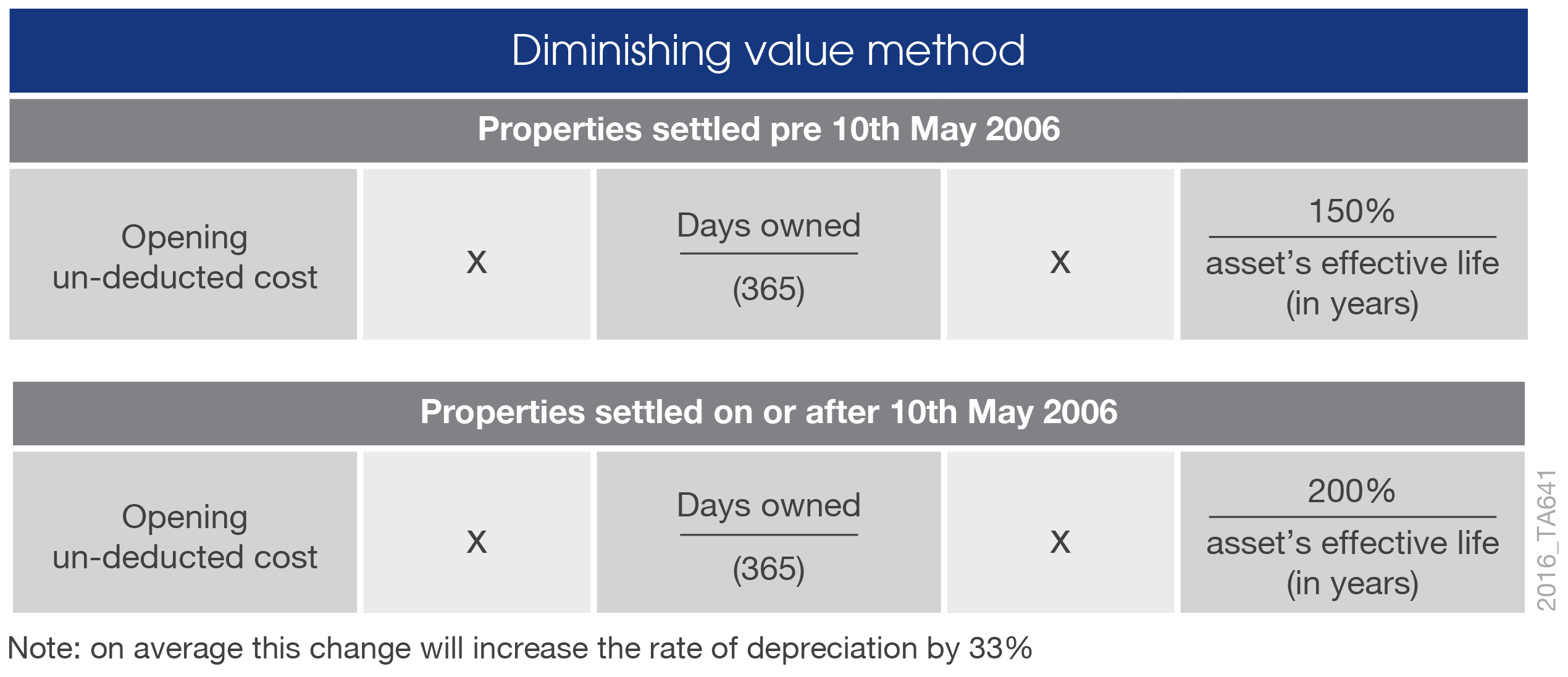

Diminishing value method Another common method of depreciation is the diminishing value method. Prime Cost Depreciation Method The prime cost depreciation method also known as the simplified depreciation method calculates the decrease in value of an asset over its. Calculate Diminishing Value Depreciation First Year diminishing value claim calculation.

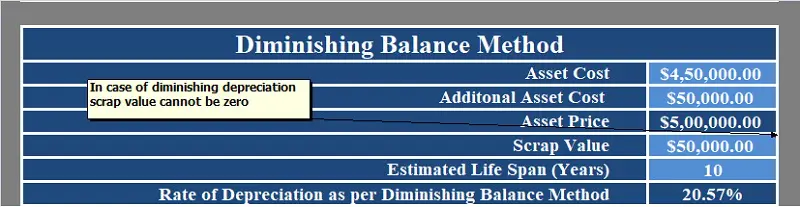

Formula to Calculate Depreciation Value via Diminishing Balance Method The formula for determining depreciation value using the declining balance method is- Depreciation. Base value days held 365 150 assets effective life Reduction for. Depreciation expenses Net Book Value.

You might need this in your mathematics class when youre looking at geometric s. The residual value is how much it will be worth at the end of its life. The depreciation rate is 60 Well here is the formula Depreciation Expenses Net Book Value.

Under the straight-line depreciation method the company would deduct 2700 per year for 10 yearsthat is 30000 minus 3000 divided by 10. In Diminishing Balance method of Depreciation we have calculated the depreciation on the closing value of. 81000 Similarly for the third year the depreciation charge will be 81000 10 R s.

80000 365 365 200 5 32000 For subsequent years the base value. What OOB depreciation method can be used for the diminishing-value method straight-line rate multiplied by 200 for. Diminishing value - depreciation Verified Hi.

50000 x 365 365 x 10 5000. Meanwhile when it comes to diminishing value method you will. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

2000 - 500 x 30 percent 450 Year 2. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. That means the submarine is going to depreciate by 80000.

Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. Cost value 10000 DV rate 30 3000. Hence using the diminishing method calculate the depreciation expenses.

Base value days held 365 150 assets effective life Reduction for non-taxable use. The DB function performs the following calculations. In this video we use the diminishing value method to calculate depreciation.

For the second year the depreciation charge will be made on the diminished value ie Rs 90000 and it will be 90000 10 R s 9000 Now the value of the equipment becomes 90000 9000 Rs. Depreciation Rate Book Value Salvage Value x Depreciation Rate The diminishing balance method of. The formula for the diminishing balance method of depreciation is.

It uses a fixed rate to calculate the depreciation values. Use the diminishing balance depreciation method to calculate depreciation expenses. If you started to hold the asset before 10 May 2006 the formula for the diminishing value method is.

Fixed rate 1 - salvage cost 1 life 1 - 100010000 110 1 -. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this.

Depreciation Highbrow

Depreciation Formula Calculate Depreciation Expense

Depreciation All Concepts Explained Oyetechy

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Depreciation Formula Examples With Excel Template

Written Down Value Method Of Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

Depreciation Diminishing Value Method Youtube

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Declining Balance Depreciation Calculator

Written Down Value Method Of Depreciation Calculation

Which Depreciation Method Is Best For You Real Estate Consumer Network

Working From Home During Covid 19 Tax Deductions Guided Investor

Written Down Value Method Of Depreciation Calculation

Straight Line Vs Reducing Balance Depreciation Youtube

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors